The Buzz on Hsmb Advisory Llc

The Buzz on Hsmb Advisory Llc

Blog Article

Everything about Hsmb Advisory Llc

Table of ContentsGetting My Hsmb Advisory Llc To WorkHsmb Advisory Llc - QuestionsSome Known Factual Statements About Hsmb Advisory Llc The Hsmb Advisory Llc PDFsThings about Hsmb Advisory LlcFascination About Hsmb Advisory LlcOur Hsmb Advisory Llc Ideas

Be aware that some plans can be pricey, and having specific health problems when you apply can boost the premiums you're asked to pay. You will certainly need to ensure that you can afford the costs as you will certainly need to devote to making these payments if you desire your life cover to remain in locationIf you really feel life insurance policy could be beneficial for you, our partnership with LifeSearch enables you to obtain a quote from a number of suppliers in double double-quick time. There are various kinds of life insurance policy that intend to meet different defense needs, including degree term, decreasing term and joint life cover.

The Best Strategy To Use For Hsmb Advisory Llc

Life insurance provides 5 economic advantages for you and your household (Health Insurance). The major advantage of including life insurance coverage to your monetary plan is that if you die, your beneficiaries get a lump amount, tax-free payment from the policy. They can use this cash to pay your final expenses and to change your revenue

Some policies pay if you create a chronic/terminal ailment and some supply cost savings you can utilize to sustain your retired life. In this short article, discover the numerous benefits of life insurance and why it might be a great idea to purchase it. Life insurance policy offers advantages while you're still to life and when you die.

Indicators on Hsmb Advisory Llc You Need To Know

If you have a plan (or policies) of that dimension, individuals who rely on your earnings will certainly still have cash to cover their continuous living expenses. Recipients can utilize plan advantages to cover critical daily expenditures like lease or mortgage settlements, utility costs, and groceries. Average annual expenses for homes in 2022 were $72,967, according to the Bureau of Labor Stats.

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Get This Report on Hsmb Advisory Llc

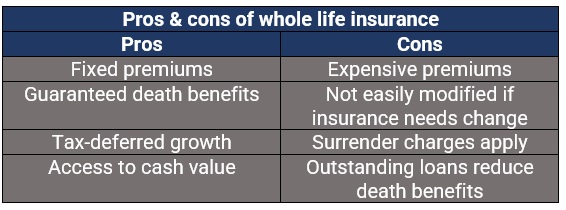

Growth is not impacted by market conditions, permitting the funds to accumulate at a stable rate in time. Furthermore, the money value of whole life insurance coverage expands tax-deferred. This indicates there are no revenue tax obligations accumulated on the money value (or its growth) until it is withdrawn. As the money worth accumulates in time, you can use it to cover expenses, such as buying an automobile or making a deposit on a home.

If you choose to borrow versus your money value, the lending is exempt to revenue tax as long as the policy is not given up. The insurance provider, nonetheless, will certainly charge passion on the finance amount until you pay it back (https://calendly.com/hunterblack33701/30min). Insurance business have differing rates of interest on these car loans

All about Hsmb Advisory Llc

As an example, 8 out of 10 Millennials overestimated the expense of life insurance policy in a 2022 study. In reality, the typical price is more detailed to $200 a year. If you assume purchasing life insurance policy might be a clever economic action for you and your family, consider talking to a financial advisor to embrace it right into your economic strategy.

The five major kinds of life insurance policy are term life, entire life, universal life, variable life, and last cost protection, also recognized as interment insurance. Entire life starts out setting you back a lot more, however can last your whole life if you maintain paying the premiums.

Hsmb Advisory Llc Fundamentals Explained

It can repay your financial obligations and clinical bills. Life insurance policy could likewise cover your home mortgage and offer cash for your family to keep paying their costs. If you have family depending upon your revenue, you likely need life insurance coverage to sustain them after you die. Stay-at-home parents and service proprietors also commonly require life insurance policy.

Generally, there are 2 kinds of life insurance coverage prepares - either term or long-term plans or some combination of the two. Life insurers provide various forms of term strategies and typical life plans in addition to "rate of interest sensitive" items which click to read more have actually ended up being much more prevalent because the 1980's.

Term insurance supplies protection for a specified amount of time. This period can be as brief as one year or offer protection for a details variety of years such as 5, 10, twenty years or to a defined age such as 80 or in many cases up to the earliest age in the life insurance policy mortality.

What Does Hsmb Advisory Llc Do?

Presently term insurance coverage prices are very competitive and among the cheapest historically knowledgeable. It should be noted that it is an extensively held belief that term insurance is the least costly pure life insurance policy coverage offered. One requires to review the policy terms meticulously to choose which term life choices are ideal to meet your specific scenarios.

With each brand-new term the premium is boosted. The right to restore the plan without evidence of insurability is an essential advantage to you. Or else, the threat you take is that your health may degrade and you might be incapable to obtain a plan at the same rates or also in all, leaving you and your recipients without coverage.

Report this page